Some of the most admired companies share one quiet advantage: a supply chain that behaves exactly the way finance models predict. Materials arrive when production lines need them, warehouses never overflow, and customers receive products on the day the storefront promised. Achieving that balance is not luck. It is the result of deliberate supply chain optimization, a discipline that turns data, software, and engineering talent into a resilient flow of goods and information.

In an era of semiconductor shortages, port closures, and overnight swings in customer expectations, small tweaks no longer suffice. Businesses need real-time visibility across the entire supply chain, the ability to stress-test scenarios in minutes, and the confidence that every decision aligns with long-term strategic objectives.

How dies software transform supply chain operations from reactive firefighting into a proactive engine for growth? This article will focus on the architectural choices, analytical techniques, and organisational changes required to secure lasting competitive advantage.

Why Supply Chain Optimization Demands a Software-First Strategy

Spreadsheet workarounds once passed for ingenuity in operations teams. That is no longer the case. Volumes spike overnight, suppliers on another continent shut down without warning, and transportation costs swing with fuel and driver availability. The business that waits a week to consolidate data pays for that delay in late fees, idle labor, and disappointed customers.

A software-first approach rewires decision cycles. Instead of emailing static reports, teams feed event streams from every distribution center into a single model that recalculates demand forecasting and replenishment every few minutes. Machine-learning pipelines identify anomalies, sudden shifts in customer behavior or unusual lead-time variance from a key vendor, long before the error becomes visible on a financial statement.

Crucially, modern supply chain optimization software embeds policy. It respects capacity constraints, quality standards, and fiscal approvals without requiring human intermediaries to police the rules. When the model recommends a change in transport mode or inventory position, executives see the underlying assumptions that produced the change.

Finally, software shortens experimentation cycles. Operations leaders can tweak supply chain management and measure projected impact on cost savings or service-level attainment, all before committing capital. The result turns infrastructure investment into tangible operating leverage, achievable only when software, not spreadsheets, sits at the core.

The strategic payoff is measurable. Companies that adopt real-time optimization see inventory buffers shrink, freight planners reroute around congestion, and finance gains early signals of cash-flow exposure. Continuous improvement becomes a product feature rather than a quarterly initiative.

From Fragmented Systems to Integrated Platforms

Most organisations own a maze of point solutions. An aging warehouse management module runs on premises, a vendor portal lives in the cloud, and half a dozen Excel macros bridge quirks the official stack ignores. The harder the team pushes for speed, the more fragile everything becomes.

How Software Consolidates Supply Chain Operations at Scale

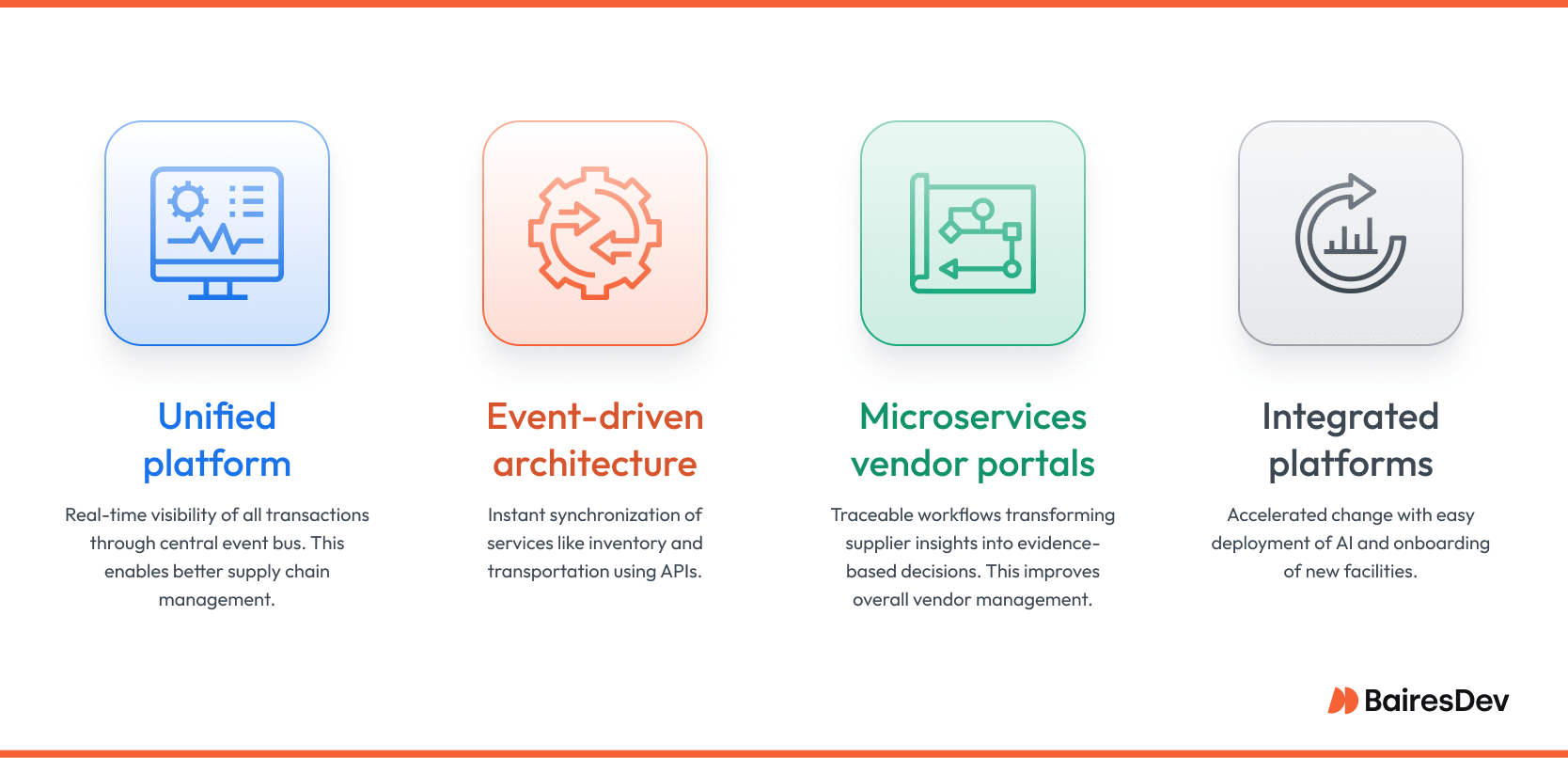

End-to-end visibility begins with a platform that treats every transaction as a data product. Purchase orders, production signals, IoT sensor readings, and customer returns feed a unified event bus.

Streaming that data through a well-defined contract lets engineering teams decouple services without losing context. When the inventory service updates its balance, transportation management immediately recalculates routing options.

Modern, resilient supply chains lean on API gateways, message queues, and schema registries to keep that choreography reliable. By shifting to event-driven processing, the business gains near real-time insight while shrinking operational overhead.

When vendors interact through a single portal backed by a microservices architecture, every workflow step is traceable. Supplier performance conversations move from anecdote to evidence. Manufacturing teams no longer debate whether a delay was caused by missing raw materials or a scheduling conflict; the data shows it.

Finally, an integrated platform accelerates product change. New distribution centers come online with ease, and adding an AI module to forecast demand at the store level becomes routine. Platform thinking turns supply chain processes into software, opening room for continuous deployment practices that were once reserved for consumer apps. Integration finished, the optimization algorithms described later in this article gain a stable foundation on which to run, iterate, and improve without human babysitting.

Supply Chain Optimization Techniques That Actually Scale

Every supply chain design textbook lists a dozen ways to trim costs and speed up flow. In practice, only a handful survive first contact with live data, surprise demand spikes, and budget pressure from finance.

Before diving into a specific algorithm, it helps to ask a simpler question: Can the technique keep working when volume triples or product mix shifts overnight?

Beyond Theoretical Models: Practical Implementations

Start with network optimization. The math is elegant, but elegance is useless if the model runs once a quarter because it needs a long weekend of compute time. Modern platforms break the work into smaller heuristics that fit inside an hourly job, then refine the answer continuously as new orders arrive. Companies that move from batch to rolling recalculations cut transportation costs without sacrificing service levels.

Inventory management follows a similar arc. Classic EOQ formulas fade when product lifecycles shorten and channels multiply. High-growth firms lean on probabilistic safety-stock engines that ingest real-time sales, supplier lead-time distributions, and even weather signals.

Transportation management rounds out the trio. Route planning once meant static lane assignments and a Friday report. Today, machine-learning agents watch driver hours, fuel markets, and warehouse queue lengths, then suggest lane swaps or mode shifts before dispatch. The trick is less about the algorithm and more about wiring it into the master schedule so the warehouse team sees the change early enough to act.

What ties these techniques together is a bias toward operational efficiency backed by continuous data. The math matters, but so does the delivery pipeline that keeps each calculation relevant. Organizations that nail both layers see cost savings materialize without the usual spike in exception handling.

Designing Software Around Real Supply Chain Constraints

Many optimization projects stall because the model assumes a frictionless world. Real supply chains are full of hard stops: union-negotiated dock hours, sustainability targets, carrier issues, and quality-control audits that simply cannot be bypassed. A robust platform factors those limits into every scenario instead of leaving planners to patch things after the fact.

Aligning Optimization with Strategic Objectives

Start with strategic objectives and work backward. If leadership has committed to a twenty-percent emissions cut, the optimizer must treat carbon budgets as first-class constraints, not after-the-report footnotes. The same logic applies to cash-flow targets, customer promise dates, and supplier performance thresholds. Embedding those boundaries into the data model prevents the classic tug-of-war where operations chases speed while finance worries about working capital.

Quality standards introduce their own twist. Pharmaceutical lines, for instance, cannot accept raw materials that have dipped below a temperature threshold mid-route. IoT tags feed that telemetry into the platform. If a reading drifts out of spec, the optimizer reroutes inventory or triggers a replenishment order without waiting for a human to discover the issue two stops later.

By weaving hard constraints into every calculation, companies build optimization engines that reflect ground truth rather than academic purity. The output is credible, actionable, and immediately executable by supply chain managers who already juggle enough surprises.

Building for Visibility and Resilience

Ask any supply-chain leader what keeps them up at night and you will rarely hear “We need another dashboard.” What they crave is confidence: the assurance that when trouble brews on the other side of the globe, they will see it early, model options quickly, and act before customers notice. Visibility and resilience are two sides of that same coin. You cannot brace for impact if you do not see the wave coming.

Why Predictive, Real-Time Supply Chain Software Is No Longer Optional

True visibility starts with a clean signal. That means ingesting sensor feeds, purchase-order changes, and carrier status updates into a single event stream, then exposing that stream to every downstream service without translation errors. Once the data flows, predictive analytics turn raw events into foresight, flagging demand anomalies or supplier delays hours, sometimes days, before legacy systems would raise an alarm.

Resilience kicks in when the platform couples prediction with automated response. Suppose a typhoon shuts down a key Asian port. The system models alternate routings, checks carrier capacity, recalculates landed cost, and presents three viable playbooks ranked by margin impact and customer-promise adherence. Human reviewers confirm the plan instead of crafting it from scratch.

Visibility also strengthens supplier relationships. Performance data shared in near real time lets partners correct course faster, turning what could be a blame game into a joint optimization effort. Over time, shared metrics evolve into joint KPIs that drive continuous improvement across the supply chain network.

Companies that treat visibility as an architectural principle, not a reporting feature, find that resilience emerges almost as a by-product. They recover from shocks faster, and in a market where loyalty can hinge on a single delayed delivery, that edge is hard to overstate.

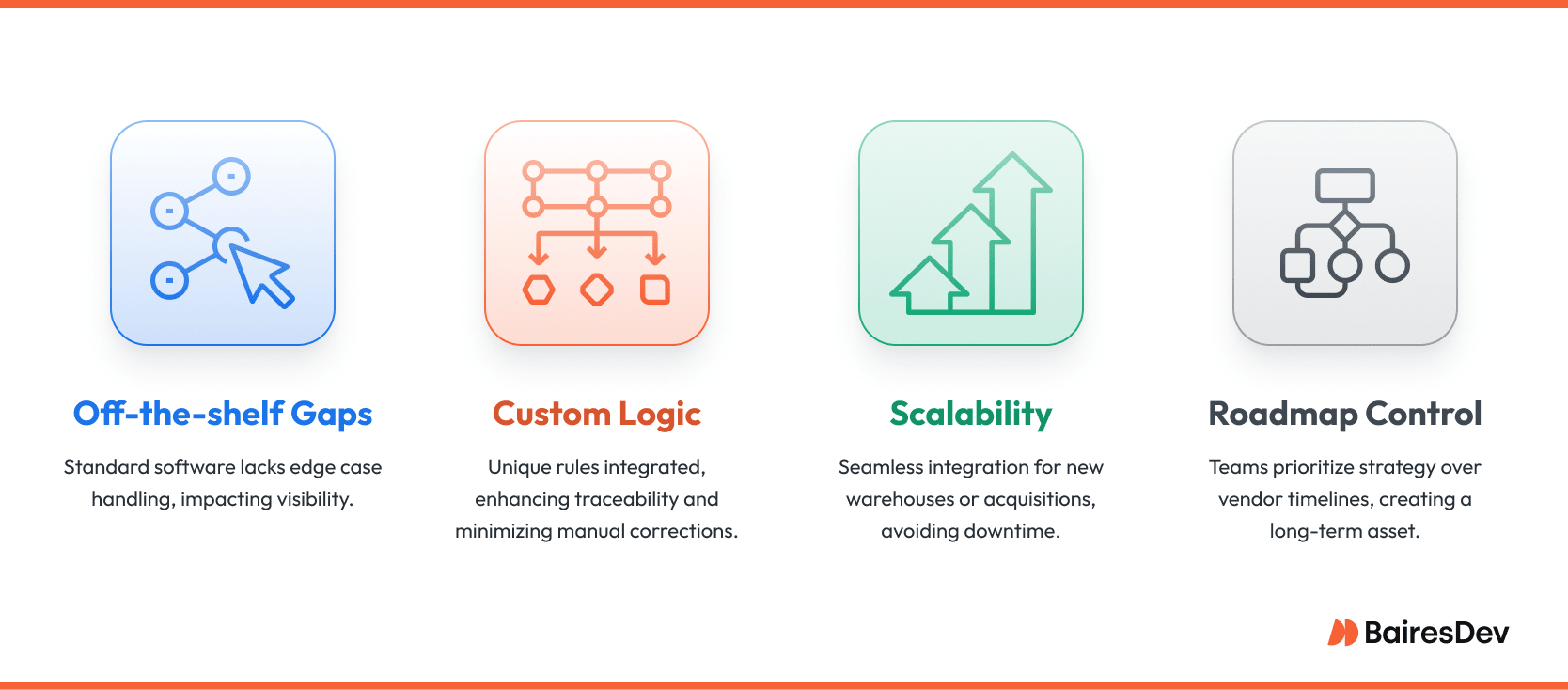

Case for Custom Software in Enterprise Supply Chains

Off-the-shelf suites have improved, yet many enterprise teams still discover that prebuilt modules only cover eighty percent of their real-world complexity. A global manufacturer might need to factor hazardous-material regulations into routing, while a retailer juggling seasonal product lines needs per-item life-cycle rules that change every quarter. These nuances rarely fit inside generic templates, and the workaround usually involves spreadsheets or shadow IT that breaks traceability.

A custom platform lets engineering leaders encode those unique policies as first-class rules rather than afterthoughts. Custom code also adapts when the network itself changes. Suppose the company acquires a competitor with three additional warehouse facilities. A configurable orchestration layer ties new nodes into existing inventory control services without rewriting the entire application.

Finally, ownership of the roadmap shifts back to the enterprise. Feature priorities align with strategic objectives, not with a vendor’s release calendar. The investment profile moves from licence fees to long-lived equity in a platform designed around the company’s competitive advantage.

Measuring Success: KPIs That Matter to Engineering Leaders

A modern supply chain team lives or dies by numbers. Leaders need signals that prove optimization is not just a theory but a sustained lift in both profit and customer experience.

Tracking Value from Chain Optimization Initiatives

Start with fill rate and on-time delivery, the two metrics that most clearly shape customer satisfaction. Next, examine inventory turnover. When optimization models balance supply with demand more precisely, cash that once sat in excess stock returns to the treasury where it funds innovation.

Transportation cost per unit shipped remains a classic indicator, yet its interpretation should widen. Cycle time speaks to engineering culture as much as it does to logistics. A shorter order-to-cash window signals that data pipelines, workflow automation, and exception handling all fire without manual chasing.

This momentum cuts rework, shrinks storage costs, and builds confidence that the next optimization sprint will pay off even faster.

Choosing the Right Engineering Partner

Selecting a development partner for supply chain optimization looks simple until the first integration exposes a brittle legacy connector or a data model with several variants of the same unit of measure. The most capable partners bring a catalogue of prebuilt adapters, yet they never assume one client’s pattern applies everywhere. They listen first, then map unique workflows onto reusable foundations.

Depth in network design processes matters as much as code quality. An engineering team that understands how distribution centres influence tax strategy or how slotting logic affects the manufacturing process will identify risks before they crystallise into delays. Look for proof in the form of past delivery where complex ERP landscapes, strict uptime targets, and multi-node orchestration came together on schedule.

Cultural alignment also counts. Nearshore squads that share business hours with U.S. stakeholders enable white-board problem-solving instead of twenty-four-hour feedback loops. Fluency in compliance frameworks such as ISO 27001 or SOC 2 reassures security leaders who sign off on production access. Ultimately, the right partner feels less like a vendor and more like an extension of the in-house platform team, able to slot in alongside DevOps, data science, and product management with minimal ramp-up.

Conclusion: Future-Ready Supply Chains Start with Software

Supply chain disruptions are never going away, and spreadsheets will not tame them. Real resilience comes from software that models reality, senses change early, and triggers a calibrated response before customers experience a hit.

Companies that invest in integrated platforms, predictive analytics, and tailor-made orchestration will treat disruption as a test they have already rehearsed. For engineering leaders, the question is no longer whether to modernize supply chain solutions, but how quickly their teams can get started.

Frequently Asked Questions

How does supply chain network optimization reduce transportation costs without hurting service levels?

Network optimization models simulate alternate lane combinations, warehouse locations, and mode mixes, then recommend the set that meets delivery windows at the lowest cost per unit shipped.

Which key performance indicators signal effective supply chain planning to executive stakeholders?

Fill rate, inventory turnover, order cycle time, and landed cost per product are reliable KPIs that translate technical work into financial impact.

What role do artificial intelligence and machine learning play in sustainable supply chains?

AI models predict demand fluctuations, optimise energy use in warehouse facilities, and identify lower-emission routes, all of which support corporate sustainability targets.

How can predictive analytics improve supplier management?

Early-warning dashboards highlight lead-time variance and quality drift, allowing procurement teams to intervene before small issues become production stoppages.

Why is real-time inventory control critical for managing customer expectations?

Accurate, up-to-the-minute stock visibility prevents overselling, shortens promise-to-ship intervals, and aligns marketing campaigns with actual capacity.

What steps help align supply chain strategy with broader strategic objectives across trading partners?

Shared data standards, joint business planning sessions, and collaborative scorecards ensure that every partner’s optimization goals support the overarching business mission.