When your platform team loses a senior engineer or your product roadmap demands a new pod, the passive versus active candidate debate becomes academic. What truly matters is your Mean Time-to-Staff (MTTS) and whether you can restore capacity before delivery commitments slip.

We need to reframe talent acquisition through the lens of operational excellence, revealing when traditional recruiting makes sense and when a nearshore partner bench can compress timelines while preserving quality.

It’s All About Delivery Velocity

Every engineering leader knows the scenario: a critical team member gives notice, and suddenly your product roadmap is at risk. The scramble to find a replacement begins, but as weeks stretch into months, the impact compounds. The feature list narrows, technical debt accumulates, and the remaining team burns out trying to cover the gap.

The traditional response involves debating whether to pursue active job seekers who are openly looking or invest time courting passive talent who might be convinced to switch. However, this framing overlooks a fundamental question: how quickly can you restore your team’s capacity to a productive state?

The talent landscape tells a compelling story about why this question matters.

Active candidates, those who are openly seeking new opportunities through job postings and recruiter outreach, represent approximately 30 percent of the global workforce at any given time.

The remaining 70 percent, according to LinkedIn, are passive candidates—professionals who aren’t actively seeking work but might consider the right opportunity. These individuals are typically heads-down delivering value at their current organizations, making them both attractive targets and challenging to engage.

This 70-30 distribution creates a fundamental tension in talent acquisition. The majority of qualified talent isn’t actively looking, yet traditional recruiting channels optimize for active candidates who may have less domain expertise than their passive counterparts.

The result is a system that often takes five to seven weeks to fill a role, according to recent Genius benchmarks, with senior and specialized positions taking significantly longer to fill.

Defining Core Metrics

To properly optimize talent acquisition, we need to adopt the same level of rigor that we apply to system performance. It starts with defining two core metrics that shift the conversation from sourcing efficiency to business impact.

Mean Time-to-Staff (MTTS)

Mean Time-to-Staff (MTTS) measures the calendar time from approved requisition or unexpected vacancy to productive day-one contribution. MTTS encompasses the entire recruitment process: sourcing, screening, technical evaluation, panel interviews, offer negotiation, notice period, and onboarding.

Unlike traditional time-to-fill metrics, which stop at offer acceptance, MTTS captures the entire timeline to restore capacity.

Capacity-Restore SLO

The Capacity-Restore SLO takes this further by establishing Service Level Objectives for staffing, similar to how we measure system reliability. For example, you might define an SLO stating that 90 percent of mid-level and senior developer positions must be filled within ten business days of the vacancy.

SLO transforms staffing from a best-effort activity to a measured operational commitment with clear success criteria.

Why MTTS Matters More Than Ever

Mean Time-to-Staff represents more than just a metric; it’s a measure of organizational resilience.

MTTS captures the complete journey from recognizing a staffing need to achieving productive contribution from a new team member. Every day of extended MTTS degrades throughput, delays features, and increases pressure on existing team members who must cover critical work while maintaining their own deliverables.

Consider the compound effects of how vacancies degrade throughput. The time-to-hire from the first contact to offer acceptance can seem like an eternity. The remaining engineers must context-switch to cover critical work, which reduces their focus on their primary responsibilities.

Engineering leaders, hiring managers, and individual contributors can spend over 15 hours per hire on interviews, further decreasing their delivery capacity. Meanwhile, momentum dissipates because long hiring cycles often lead highly qualified candidates to accept other offers, forcing you to restart the entire hiring process from scratch.

The traditional response to these challenges is to attempt to accelerate the funnel through more aggressive sourcing or relaxed standards. However, this often compromises quality or burns out interviewers.

What we need instead is a fundamental rethinking of how we approach capacity restoration, one that optimizes for both speed and sustainability without sacrificing the quality bar that our products demand.

Navigating the 2025-2026 Hiring Realities

The current hiring environment presents unique challenges that make traditional approaches even less effective. The market has shifted dramatically from the talent wars of 2022, with data showing sluggish tech hiring and uneven demand across sectors.

Organizations now prioritize the quality of hire over pure speed, implementing more rigorous skills-based assessments even as they strive to compress timelines. These hiring practices create a paradox where companies need faster staffing to maintain delivery velocity, yet they’re implementing more thorough evaluation processes that naturally extend timelines.

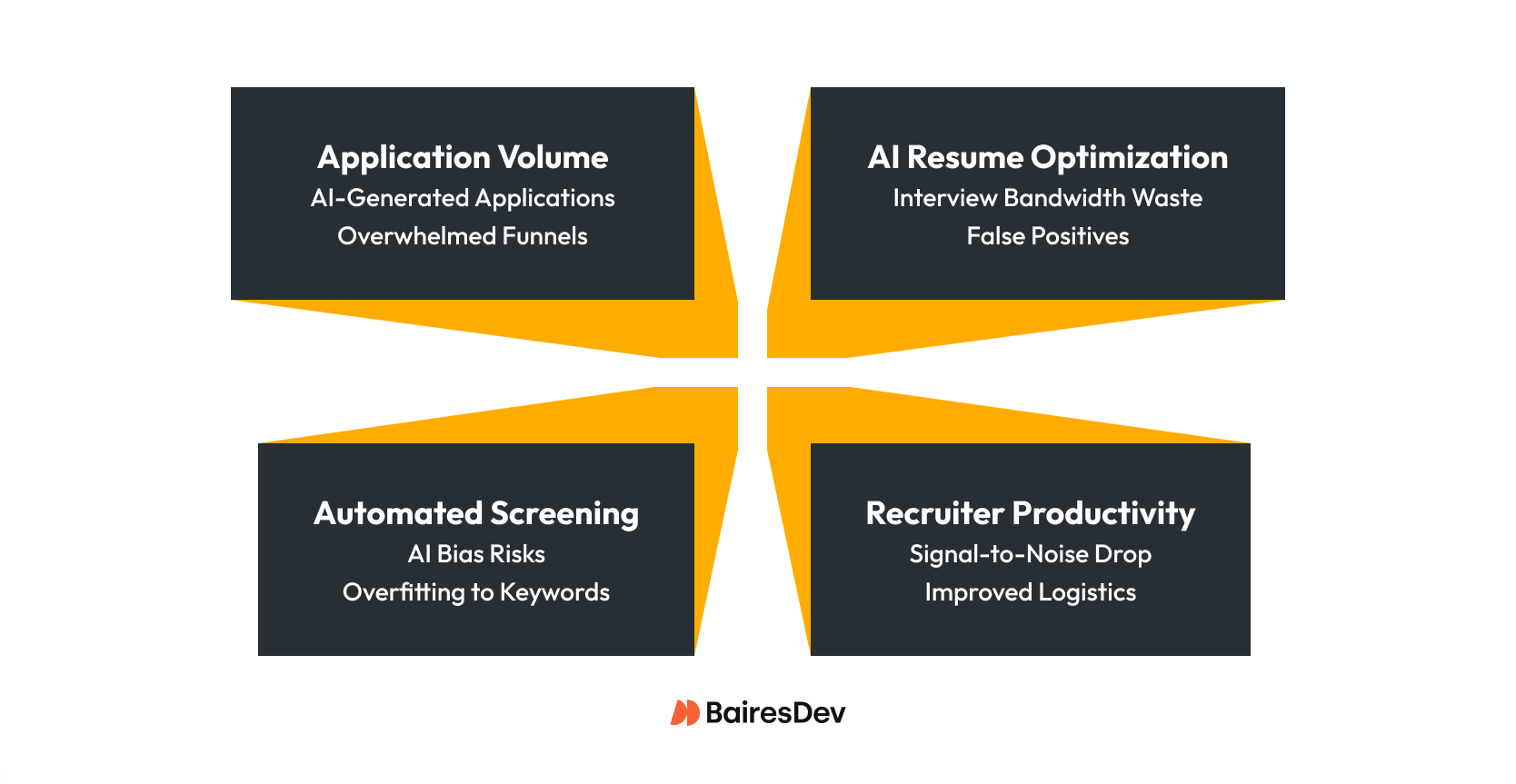

Artificial intelligence has fundamentally altered the way candidates enter and progress through the recruitment funnel. According to The Washington Post, early screening is increasingly automated, with AI tools processing initial applications and conducting preliminary assessments. While this promises efficiency, the reality is more complex.

Application volumes have exploded. AI-assisted tools now make it trivial for candidates to apply to hundreds of positions. Worse, many resumes are themselves AI-generated, carefully optimized to game applicant tracking systems rather than reflect genuine capabilities. The result? A dramatic surge in false positives. Candidates who sail through automated screening often stumble in human interviews, wasting precious technical interview slots that your team can’t afford to lose.

These technological shifts compound the challenges created by broader market dynamics. Market predictions for hiring through 2026 suggest a cautious yet optimistic rebound, characterized by moderate growth, particularly in sectors such as AI, HR transformation, and organizational development.

Rather than the stop-start recruiting campaigns that lose momentum and context, organizations need flexible capacity models that can scale with demand while maintaining institutional knowledge and expertise. This shift demands new frameworks that align talent acquisition with engineering delivery objectives.

Reframing Success Through Technical Metrics

Consider the mathematics behind a typical internal recruiting process for a senior engineering role.

You start with two hundred resumes. After initial review, forty candidates receive recruiter screens. Half advance to technical interviews. Of those twenty, eight make it to panel interviews. Three receive offers. If you’re fortunate, one accepts.

The timeline? It will take five to seven weeks if everything goes smoothly. The hidden cost? Sixty to eighty hours of engineering time spent in interviews rather than shipping code.

Now, consider a vendor bench model in contrast. You begin with pre-vetted candidates who’ve already passed initial screening, typically with pre-negotiated terms. Timeline: up to two weeks. Engineering time invested: fifteen to twenty hours.

Speed isn’t the only difference. It’s about predictability. The bench model dramatically reduces variance by maintaining a continuously validated talent pool, essentially converting passive candidates into ready-to-deploy resources.

Understanding Your Options: A Strategic Comparison

Each talent acquisition channel serves different needs and carries distinct trade-offs that become clear when viewed through the lens of the MTTS.

Active Sourcing

Active sourcing offers access to a large pool of candidates with a clear intent to change roles. The evaluation process is standardized and well-understood. However, the noise-to-signal ratio has significantly degraded with AI-generated applications, and the extended MTTS of five to seven weeks poses meaningful delivery risks.

This approach works best for junior roles, widely available skills, or situations where time isn’t critical and you can afford the investment in interview bandwidth.

Passive Sourcing

Passive sourcing offers access to proven performers with demonstrated stability and expertise. The quality-to-quantity ratio is superior, and the candidates currently employed provide a positive signal about their capabilities. Yet the weaknesses are substantial: engagement cycles stretch even longer than active sourcing, recruitment costs increase significantly, and extended notice periods of four weeks or more further delay the restoration of capacity.

Attracting passive candidates is not easy. Response rates typically hover below twenty percent, making this a numbers game that requires substantial investment. This channel is suitable for senior or specialized roles, leadership positions, and situations where quality takes precedence over speed.

Partner Bench Model

The partner bench model, specifically a nearshore full-time arrangement rather than a freelancer marketplace, offers a distinct value proposition. Pre-vetted talent becomes immediately available, compressing MTTS to one to two weeks. Interview burden drops by 75 percent, freeing engineering time for actual delivery work. Continuous calibration ensures quality, while predictable capacity and costs facilitate improved planning and budgeting.

The trade-offs include vendor management overhead, the need to align company culture, geographic or time zone constraints, and dependency on the quality of the partner. This model excels at rapid backfilling, quickly scaling teams, maintaining delivery velocity, and reducing the interview load on existing teams.

Comparative Analysis: The Numbers That Drive Decisions

|

Metric |

Active Sourcing | Passive Sourcing |

Partner Bench |

| Mean MTTS | 5-7 weeks | 8-12 weeks | 1-2 weeks |

| P95 MTTS | 12+ weeks | 16+ weeks | 3 weeks |

| Interview Hours per Hire | 60-80 hours | 80-100 hours | 15-20 hours |

| Candidate Drop-off Rate | 40-50% | 60-70% | <10% |

| Notice Period Impact | 2-4 weeks | 4-8 weeks | Immediate |

| IP/Knowledge Continuity | Variable | High | Maintained via partner |

| Security Vetting Timeline | Concurrent with hiring | Concurrent with hiring | Pre-completed |

| Quality Bar Maintenance | Variable, depends on the funnel | High, proven performers | Consistently calibrated |

| Scalability | Limited by interview capacity | Limited by outreach capacity | Elastic within bench size |

When we examine the quantitative comparison across active and passive recruitment, the impact on delivery capacity becomes stark.

Mean MTTS ranges from five to seven weeks for active sourcing, extends to eight to twelve weeks for passive sourcing, but compresses to just one to two weeks with a partner bench. The 95th percentile numbers are even more dramatic: over twelve weeks for active sourcing, over sixteen weeks for passive, versus just three weeks for a bench model.

Interview hours tell another critical story about the hidden cost of traditional recruiting. Active sourcing consumes sixty to eighty hours per hire, while passive sourcing requires eighty to one hundred hours due to additional cultivation time. A partner bench cuts this to fifteen to twenty hours, returning the equivalent of two full engineering weeks to your team per hire.

Candidate drop-off rates reveal the inefficiency in traditional funnels, with forty to fifty percent of active candidates and sixty to seventy percent of passive candidates withdrawing during the process. Pre-vetted bench candidates drop off at a negligible rate, as they are already committed.

Notice periods add another layer of delay, with active candidates typically requiring two to four weeks and passive candidates needing four to eight weeks to transition. Bench resources are generally available immediately or within days.

Perhaps most importantly for long-term success, knowledge continuity varies significantly across channels. Active sourcing offers variable continuity, depending on the quality and tenure of the candidates. Passive sourcing typically delivers high continuity given candidates’ proven track records. A bench model maintains continuity through the partner relationship, ensuring institutional knowledge persists even as individual engineers rotate through projects.

Risk Controls for Enterprise Deployment

For organizations considering a partner bench model, establishing proper risk controls is non-negotiable.

Security and compliance must be addressed proactively, not reactively. Meaning, completing background checks, reference verification, and any required security clearances before bench placement, not during the hiring process. Legal frameworks, including NDAs, IP assignments, and confidentiality agreements, should be executed upfront to create a legally sound foundation for rapid deployment.

Operational controls focus on ensuring productivity and quality. Time zone optimization should guarantee at least four hours of daily overlap with your core team, enabling real-time collaboration on complex problems. Communication standards must be explicitly defined, including preferred channels, response SLAs, and escalation paths for urgent issues.

Partner incentives should align with both engineer retention and satisfaction, rather than just placement speed. Knowledge management requirements, including documentation standards and handoff procedures, ensure continuity even as team composition evolves.

Visualizing Success Through Operational Metrics

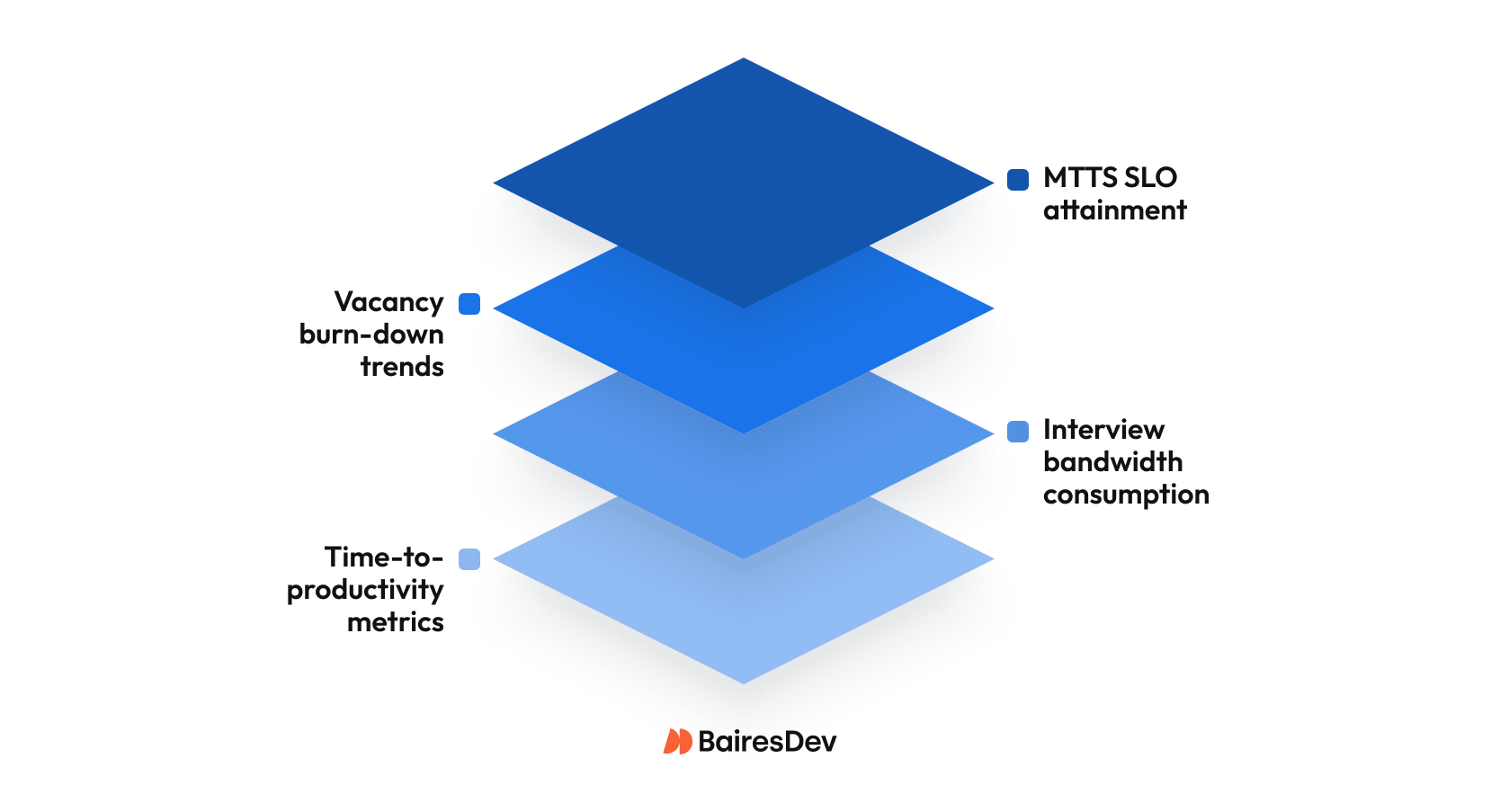

Next, forward-thinking engineering organizations are applying SRE principles to talent acquisition, tracking staffing performance in the same manner as any other critical system.

Your capacity dashboard should treat open positions as incidents with defined severity levels based on impact to delivery:

- Track MTTS SLO attainment as a key performance indicator, showing the percentage of positions filled within target timeframes.

- Monitor vacancy burn-down trends over time to identify systemic issues versus one-off delays.

- Measure the consumption of interview bandwidth to understand the actual cost of traditional recruiting on team productivity.

- Calculate time-to-productivity metrics that capture not just hiring speed but how quickly new team members contribute meaningful value.

This operational view transforms recruiting from an HR function to an engineering reliability concern, appropriate given that staffing directly impacts delivery capacity. When talent acquisition is measured and managed with the same rigor as system performance, organizations can make data-driven decisions about how to optimize their recruitment strategies.

The Strategic Imperative for 2025 and Beyond

The hiring landscape for 2025 and 2026 necessitates a fundamental reevaluation of talent acquisition strategies.

Quality-first automation means that while AI handles initial screening, live technical interviews remain critical for assessment. Organizations must audit their AI screening tools for bias and implement human review checkpoints for essential roles to ensure fairness and accuracy. The goal is to maintain skills-based evaluation while leveraging automation for logistics and scheduling, rather than replacing human judgment in technical assessments.

Market conditions necessitate flexible capacity planning that can adjust to shifting demands without losing momentum. Rather than stop-start recruiting campaigns that lose context and relationships, maintain steady-state capacity through continuous bench relationships for predictable needs, flexible engagement terms that scale with demand, and retention of institutional knowledge through long-term partnerships.

Perhaps most critically, organizations must preserve interview bandwidth as a scarce resource. With engineering managers spending up to 20 percent of their time on hiring activities during growth periods, protecting IC and EM bandwidth becomes essential for maintaining delivery velocity.

Delegate initial technical screens to specialized partners or bench providers who can hold your quality bar. Implement structured interview processes that minimize redundancy and maximize signal. Use pre-vetted benches to skip early funnel stages entirely, engaging your team only for final validation and culture fit assessment.

The Nearshore Advantage: Converting Passive Talent to Ready Capacity

A properly managed nearshore bench fundamentally changes the MTTS equation by solving the passive candidate paradox.

Rather than competing for candidates’ attention through time-consuming passive recruitment efforts, outreach and cultivation, bench partners maintain a continuously validated pool of engineers who have already expressed interest in pursuing new opportunities. These aren’t freelancers juggling multiple projects but full-time engineers with demonstrated stability and commitment.

The model maintains calibration through regular technical assessments, ensuring skills remain current and aligned with your needs. Cultural fit is preserved through ongoing engagement that maintains alignment with client values and working styles. Timeline compression happens naturally by eliminating sourcing delays, initial screening overhead, and notice period waits. Variance reduction occurs through pre-qualified talent, which minimizes failures.

This approach converts the theoretical advantage of passive job seekers—proven performers with demonstrated expertise—into practical, deployable capacity that can be activated within days rather than months.

The Bottom Line for Engineering Leaders

Engineering leaders need predictable, high-quality capacity restoration that doesn’t compromise delivery or burn out their teams. By focusing on MTTS optimization and implementing a mixed-channel strategy that includes nearshore bench partners, organizations can significantly improve their ability to maintain delivery velocity through staffing transitions.

They can reduce the mean time-to-staff by 70 to 80 percent, cut the interview burden by 75 percent, maintain quality while improving predictability, and protect delivery commitments during transitions. These aren’t theoretical benefits but measurable outcomes that instantly affect your ability to deliver value to customers.

The question isn’t about active and passive candidates, it’s how to structure your talent supply chain to minimize MTTS variance while maintaining the quality bar your products demand. In the current market, that increasingly means leveraging pre-vetted bench capacity and taking advantage of immediate, deployable resources.

The organizations that master this approach will maintain their competitive advantage not through winning the war for talent, but by fundamentally restructuring how they restore capacity when staffing gaps threaten delivery.