Spreadsheets have their moments, but once a company starts adding new product lines or opening a second warehouse, the cracks show. People chase different versions of the same report, and the month-end close becomes an obstacle course.

That tipping point is when teams begin looking at enterprise resource planning (ERP) as more than a buzzword.

ERP systems do something a ledger or point solution never could: they pull finance, HR, supply chain, and customer data into one place and keep it in sync. Think of a single database that feeds payroll runs, purchase orders, service tickets, and even your customer portals. When the warehouse supervisor updates inventory, the sales forecast reflects it a few seconds later.

Because everything lands in the same software system, the usual “where did this number come from?” meetings disappear. Accountants stop re-keying vendor invoices, and planners trust the stock figures on their screen. Most modern ERP solutions let you install only the pieces you need—finance today, perhaps production scheduling next quarter—so you do not pay for unopened boxes.

What is an ERP System?

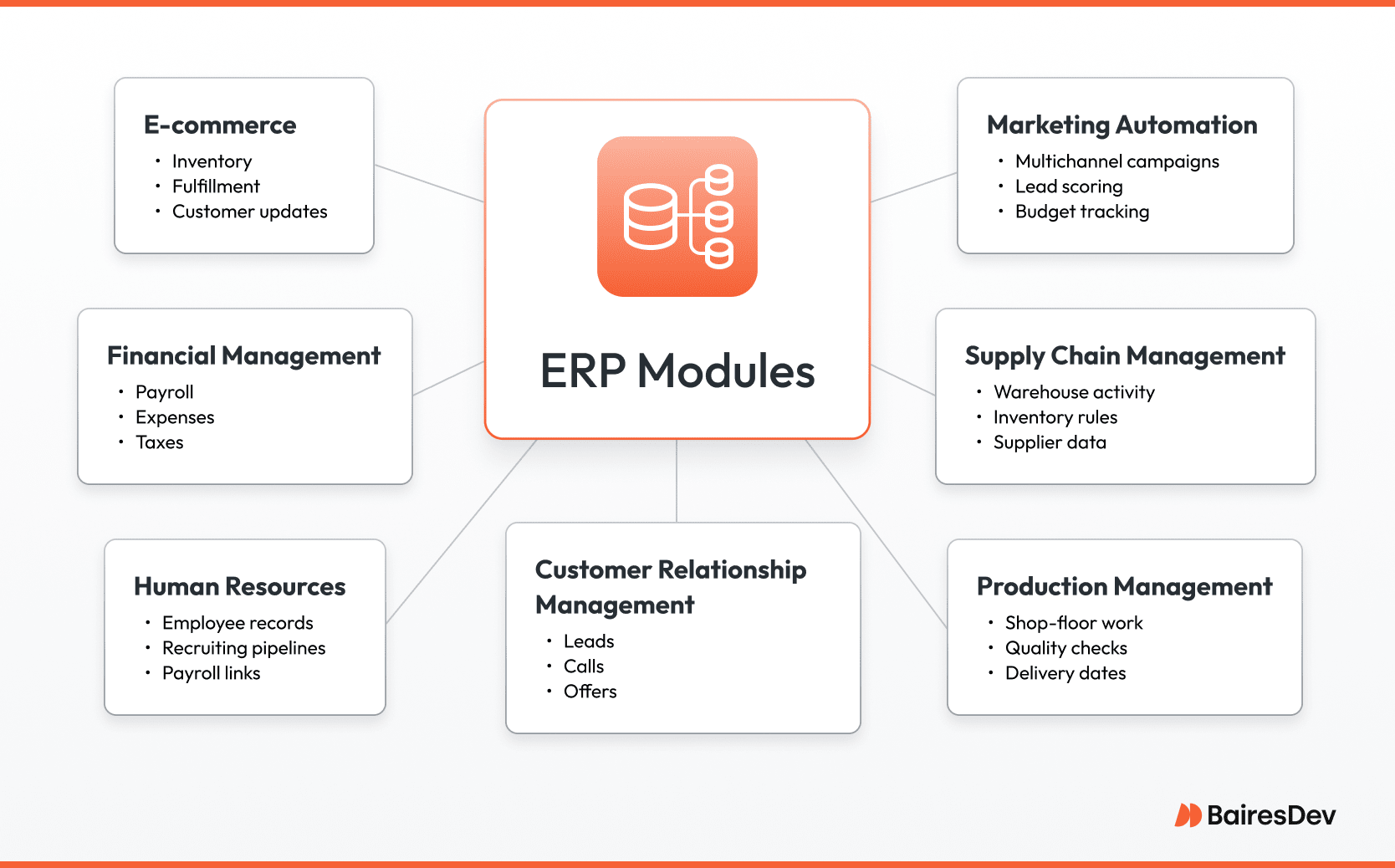

At its core, ERP is a collection of modules. Each module focuses on one slice of the business: managing cash, onboarding staff, coordinating shipments, nurturing customers, and so on. All ERP modules share a common database, so a change anywhere updates everywhere.

That architecture delivers two benefits:

- Reports draw on current data instead of yesterday’s export.

- The business runs one set of rules for currencies, tax codes, or part numbers, which reduces manual reconciliation.

Deployment is flexible. Some firms keep everything on-premises because regulations or latency requirements leave them little choice. Others push their ERP solution into the cloud to avoid hardware upkeep and to tap machine-learning add-ons the vendor supplies. A growing number run hybrid setups—finance servers in-house, customer analytics off-site—balancing control with scalability.

Why Companies Bother with ERP

Done well, an ERP system pays off in several areas. Routine work shrinks. A controller no longer triple-checks vendor payments because the system reconciles them in real time.

Decision cycles shorten, as managers read current margin data instead of waiting for weekly summaries. Visibility improves across departments, so supply-chain teams see open sales orders and can adjust safety stock before a shortage blindsides production. Customer service benefits too. When an agent pulls up an account, shipping status and billing history are already there.

There is a cost story as well. Automation trims errors that turn into charge-backs or write-offs, and it frees staff for analysis instead of data entry. Perhaps most important, the platform grows with the company. You can bolt on a project-management module when the engineering group expands, or switch on multi-currency support the first time you invoice overseas.

A Quick Note on Cloud-based ERP Systems

Running ERP in the cloud is not a silver bullet, yet the model offers real perks: easier updates, elastic capacity during seasonal spikes, and access to vendor-hosted AI tools that forecast demand or flag fraud patterns. The downside of cloud ERP is that you are giving up some configurability and trusting external security controls, something risk teams need to vet carefully.

Bottom Line

An ERP system turns scattered data into a single source of truth and automates work people should not be doing by hand. It is not cheap, and implementation takes grit, but for companies pushing past startup scale, the alternative is a maze of disconnected systems that slow every decision.

The modules that make up an ERP platform (finance, HR, supply chain, CRM), provide the building blocks. Pick the right mix, keep the data clean, and the payoff is more time spent on strategy and less on copy-and-paste firefighting.

Common ERP Modules in Practice

Financial Management Module

The financial module handles the essentials—payroll runs, ledgers, receivables, and payables—but its real value shows when it links every transaction back to the aforementioned single source of truth. It also owns cash management, giving treasury teams a live view of every bank balance and upcoming obligation. On the day-to-day side, built-in expense management routes employee claims to the right approver and posts them to the ledger automatically. A controller can pull a cash-flow forecast and trust that vendor invoices and department budgets are already factored in. Multi-currency and tax engines plug in for teams that sell across borders, so the month-end scramble to reconcile exchange rates disappears.

Supply Chain Management

Inventory is more than a count of boxes on a shelf. Good supply chain management links warehouse management tasks—receiving, put-away, bin transfers—directly to inventory management rules like reorder points and safety stock.. Receiving clerks book goods in once; the data rolls forward to purchasing and production without extra clicks. Because suppliers see accurate demand signals, negotiations shift from guesswork to facts, and compliance records stay clean.

Customer Relationship Management

A CRM module stores leads, contacts, and the story of every call or email. That history lets support reps answer with context instead of scripts. Dashboards can segment customers by buying pattern or region, helping sales focus on high-value prospects. When marketing spots a rise in repeat orders from a particular sector, product teams get an instant prompt to consider upsell bundles.

Human Resources

Human resources management modules keeps personal details, salary bands, and reporting lines in one place. Managers run performance reviews without chasing spreadsheets, while recruiters track openings, candidate pipelines, and offer letters from the same screen. Expense claims feed straight into finance, so reimbursements happen quickly and audit trails stay intact.

E-commerce Module

Online sales introduce their own complexity—tax rules differ by state, and product availability changes by the hour. The e-commerce module connects the storefront to inventory and warehouse data, preventing the dreaded “out of stock” email after checkout. Order management routes purchases to the nearest fulfillment center and updates customers automatically with shipment status.

Marketing Automation

Campaigns span email, web, and social channels, but the budget should live in one ledger. Marketing automation tools schedule sends, score leads, and track spend. When a campaign starts costing more than it converts, the dashboard shows it in near real time. Teams can pivot content or pull the plug before the quarter’s budget is gone.

Production Management

For manufacturers, production scheduling is the heartbeat of the plant. The module assigns work orders, checks material availability, and tracks each lot through quality control. If a run falls behind, supervisors see it early and adjust shifts instead of missing delivery dates. Tighter visibility also means fewer defects, because quality data travels back to engineering for quick fixes.

Together, these modules let a business run on shared facts, not stitched-together spreadsheets. Pick the ones that solve today’s pain points, then add more as the operation scales.

Core ERP Modules: Finance, Connectivity, and Control

Financial Management

Every ERP suite starts with finance. The module pulls together general ledgers, payables, accounts receivable, cash forecasts, budgets, even fixed-asset schedules. Controllers can open one screen to see liquidity for the week and another to drill into late customer invoices. Treasury staff track currency exposure instead of juggling spreadsheets. Budget owners model next quarter with current spend already factored in, so nobody is guessing at burn rate. Automated depreciation keeps asset values current, while built-in tax engines handle the local rules that change every fiscal year. With live data flowing in, the finance team spends less time reconciling and more time spotting trends that matter.

Integration with the Rest of the Stack

Finance does not work in isolation. When the ERP pipe connects to CRM, a sales order raises an automatic receivable and the shipping department sees it right away. Tie-ins to supply-chain modules push purchase-order receipts straight into inventory and accounts payable. Asset-management links feed depreciation schedules back to finance without extra key-strokes. The result is a single version of events that travels from quotation to cash collection. Fewer data hand-offs mean fewer surprises at month-end and faster answers when leaders ask, “Can we take on that new project next quarter?”

Security and Compliance

Money data attracts scrutiny, so the platform locks it down. A built-in risk-management dashboard watches for unusual patterns—duplicate vendor records, sudden spikes in payables—alerting finance before small issues snowball. Role-based access limits who can post journals or approve payments. Every change leaves an audit trail that external auditors can trace without digging through email chains. Encryption protects records in transit and at rest.

Regulation never stands still, which is why good systems ship updates for mandates such as SOX or GDPR instead of leaving teams to invent work-arounds. Built-in risk dashboards surface unusual patterns—duplicate vendor accounts, unexpected cash movements—before they turn into headlines. Internal controls live inside the workflows rather than in a binder no one opens.

When finance, integration, and security line up, an ERP installation becomes more than accounting software. It turns into the nerve center that lets a company scale without losing sight of its cash, its customers, or its compliance obligations.

Well-known ERP Platforms and Where Each Fits

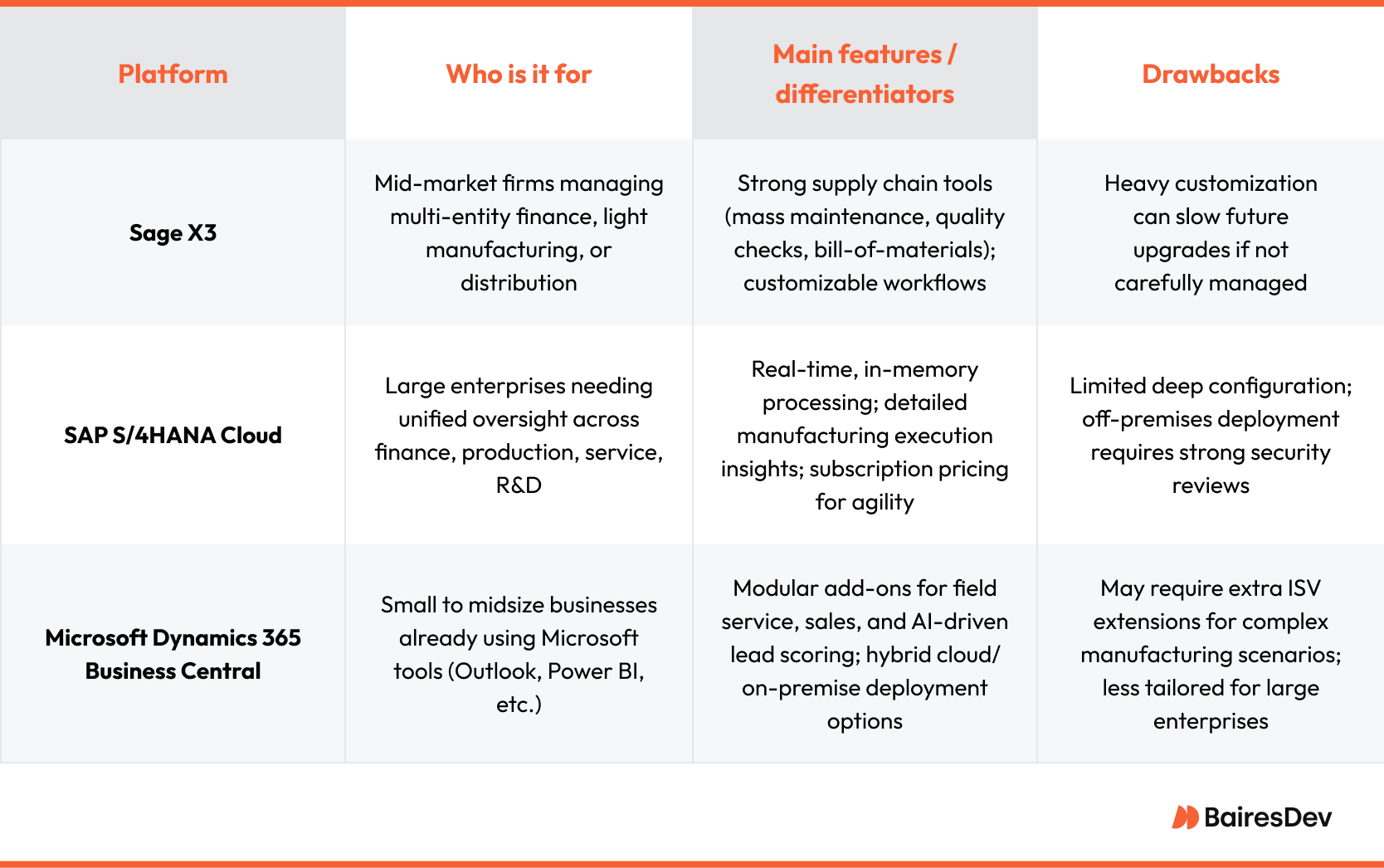

Selecting an ERP software suite is less about chasing a feature checklist and more about matching the platform to how your company operates today—and how it will operate three years from now. The three products below dominate most shortlists for different reasons.

Sage X3

Sage aims squarely at mid-market firms that juggle multi-entity finance and light manufacturing or distribution. Finance, project accounting, and inventory sit in the same database, so the income statement lines up with stock levels without extra reconciliation.

Supply chain management modules cover mass maintenance, quality checks, and bill-of-materials planning, which helps contractors handle change orders without starting over. Product-lifecycle add-ons track items from concept to retirement. The trade-off is customization depth: Sage lets teams tweak workflows liberally, but heavy tailoring can slow future upgrades if governance slips.

SAP S/4HANA Cloud

SAP targets enterprises that need a single lens across finance, production, service, and R&D. The in-memory database keeps large transaction volumes responsive, while the manufacturing execution system shows work-in-progress data down to the shop-floor workstation.

Real-time views help teams balance capacity and material constraints before they become bottlenecks. Subscription pricing reduces capital outlay, yet companies give up some low-level configuration freedom in exchange for standardised, fast-evolving releases. Security reviews are essential because sensitive data now lives off-premises.

Microsoft Dynamics 365 Business Central and Modules

Dynamics appeals to small and midsize businesses that already rely on Microsoft tools. Core finance, supply chain, and project tracking integrate with Outlook and Power BI, so users operate inside familiar interfaces. Separate modules cover field service, sales, and AI-assisted lead scoring.

Hybrid deployment keeps latency low for sites that still need on-premise components, while cloud instances scale during peak order seasons. The platform shines at quick starts, though complex manufacturing scenarios may require extra ISV extensions.

Why Companies Commit to ERP Solutions

When every department maintains its own data, people spend hours reconciling numbers instead of acting on them. A well-implemented ERP stores transactions once, routes them where they are needed, and enforces the same definitions along the way. The sales forecast you present to finance is the same data operations uses to schedule production, and customer service taps that identical record to check shipping status.

Vendors also sell ERP à la carte. You might begin with finance and inventory, then activate production scheduling or e-commerce when growth demands it. Paying only for what you use keeps the entry cost reasonable—a welcome shift from the all-or-nothing licenses of the past.

Implementation still carries real work. Accurate data must be ensured, processes trimmed, and people trained. Firms that invest up front in change management usually hit go-live with fewer surprises and a faster payback.

An ERP is not merely another application. It is the backbone that lets integrated data flow from quote to cash without manual detours. The hard part is choosing a platform whose strengths align with your own priorities, then keeping customisation restrained enough that future upgrades remain straightforward.